What Investors

Do & Don’t Like

Aditi Dash is a partner at CircleUp Growth Partners, a data-driven venture fund focused exclusively on early-stage consumer brands. She loves long walks and short stories. You can find Aditi on LinkedIn, Twitter and adash@circleup.com

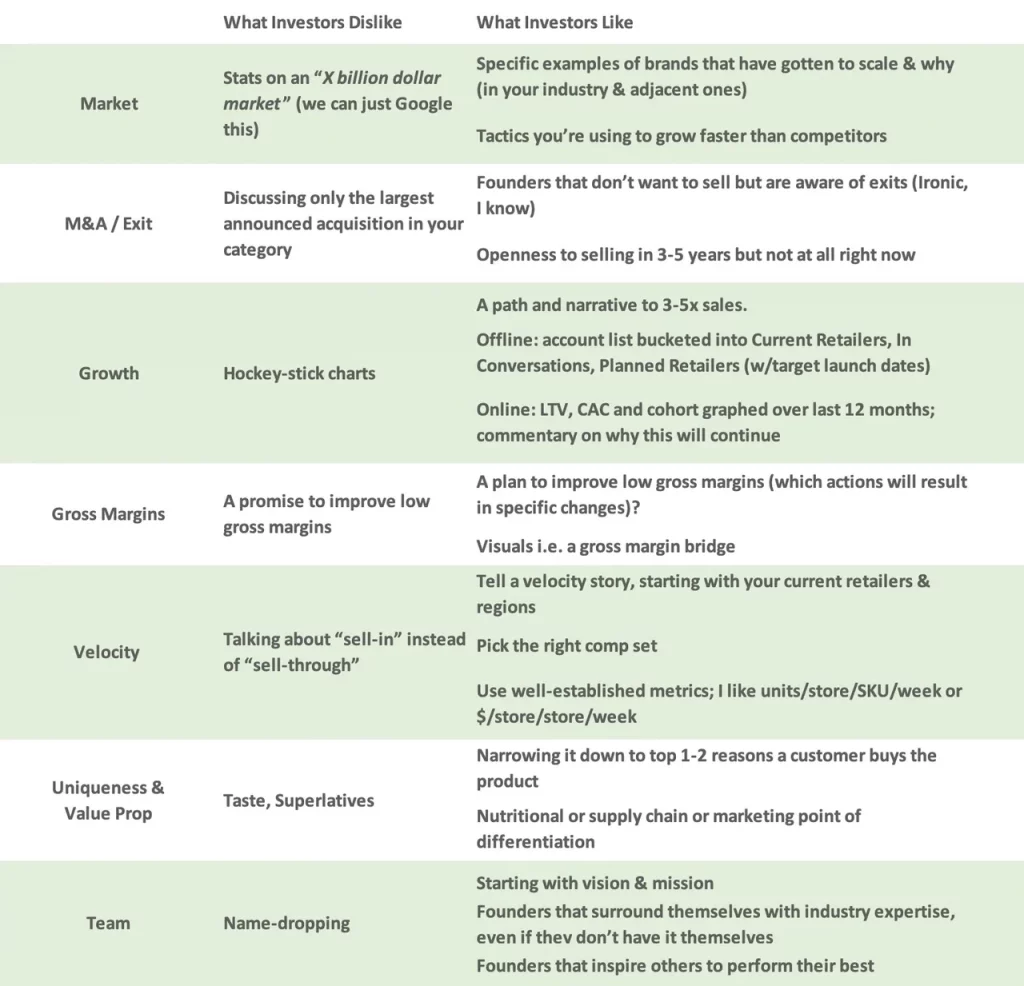

Investors like a story. When talking to founders of early-stage brands, the most compelling ones are those that can communicate their narrative to the rest of the world (customers, retailers and investors). Here, we break it down by topic.

But first, COVID-19

It feels like we’re living in a “wait and see” world. So much of our personal and professional lives are on pause due to the current COVID-19 crisis. On a macro level, this means fewer deals will get done in 2020.

According to a recent survey by First Republic, 81% of investors plan to make 2 or fewer investments/quarter in 2020 compared to only 56% in 2019.

Furthermore, profitability and future financing risk are top of mind for investors. There will be a lot more scrutiny of both topline and bottom line in coming months. As a result, founders must be extra buttoned-up during their fundraising pitches.

What makes a business compelling to investors?

From the investor perspective, we’re looking to fund businesses and teams that have a big mission to solve a major pain point for consumers and can tell a story to explain why things have happened a certain way. Valuation expectations have always been high for good companies. But, what makes a company “good”?

Let’s imagine a nutrition bar company that is raising $1-3M for continued growth:

- Large market opportunity (a $1Bn+ segment of consumer). A “good” company makes it easy for investors to answer our favorite question: how big can this get?

- What Investors Don’t Like: The nutrition bar market is $20Bn market, growing at 2.5% year-over-year.

-

- What Investors Like: While the nutrition bar category is a large one ($20Bn in annual sales), we also recognize that it is a crowded one. We are focused on carving out a niche in this market using tactics unique to our brand and management team. We also look to recent winners in adjacent categories to learn best practices in scaling a brand rapidly i.e. Super Coffee in the refrigerated beverage world.

- Evidence of M&A in the category. Investors always ask: who buys this? In the best companies, we can point to a large number of buyers and precedent transactions that help set the valuation.

- What Investors Don’t Like: Kellogg bought RXBar for $600M!

- What Investors Like: Historically, the nutrition bar category has been an acquisitive one. We all know about Kellogg’s purchase of RXBar, but it’s also worth pointing out the sales of Quest, ONE Brands and Perfect Bar. While we’re not thinking about exit on a daily basis, we believe that after our Company gets to $30M in sales, there’s an opportunity to sell our brand at a premium valuation.

- Growth: The best companies see sales doubling year-over-year in early years, even off a higher base (think $5M net sales doubling to $10M).

- What Investors Don’t Like: We’ll be at $100M in sales in 5 years.

- What Investors Like: We have purchase orders in hand that will double our sales this year. These POs are from Retailer X, Retailer Y and Retailer Z. The retailers like our brand because we’re solving THIS key pain point for their customers In addition to the POs, we are in conversations with Retailer A, Retailer B and Retailer C (follow-up with a list of retailers, stage of conversation & probability of closing). Our online sales doubled last year, and we believe this trend will continue this year, given increased consumer adoption of online purchasing.

- Sustainable gross margins: The best companies have a gross margin above 50%. The median gross margin for food & beverage brands is between 40-45%. If your gross margin is lower, it’s really important to address (1) plans to improve gross margin and (2) future capital needs.

- What Investors Don’t Like: Our current gross margins are 20% or less, but we will have 60% gross margins by the end of the year.

- What Investors Like: Last year, gross margin was 20% – this was mainly due to higher cost of goods sold, given our early scale. Our manufacturer has laid out volume requirements that we’ve already started hitting to bring up the gross margin. We priced our product at a 60% gross margin at scale, which we plan to hit in 12 months. Here’s a month-by-month gross margin bridge.

- Best-in-class velocity: businesses investors like to fund create and market products that sell more than those of competitors

- What Investors Don’t Like: Walmart just ordered 1,000 units – we’re killing it on-shelf!

- What Investors Like: In the region that we’ve been selling the longest, we’ve outsold the top nutrition bar every month for the last three months. We believe this is due to our messaging, brand and core value proposition. We believe we can expand this performance to other regions and retailers, many of which are already in the sales pipeline.

- Uniqueness & Value Prop: It’s really important to articulate the value of a brand to consumers in a way that matters. What problem does this solve?

- What Investors Don’t Like: Our product tastes better! That’s why we win!

- What Investors Like: Our customers care most about cutting the amount of sugar that they eat. Relative to all of our competitors in nutrition bars, we have less sugar per ounce. We put this front and center of our packaging and on our website – it’s the #1 reason that consumers come back for a second purchase and it’s the most frequently mentioned attribute in our Amazon reviews. The reason we can do this is because of a moat we’ve built around our product (either on the supply chain or marketing side) – it’s not something anyone else can come in and do tomorrow.

- Great team: a founder that is articulate, passionate, humble and ruthless all at once. Someone who knows when to ask for advice and when to switch over to asking people to do what she or he wants.

- What Investors Don’t Like: I’m friends with the CEO of Walmart, and he absolutely loves us. I just got off a call with the RxBar CEO – he’s pumped about us!

- What Investors Like: We are the best team to execute on this uniqueness and value proposition, because of our unique insight that sugar is the number one reason that people buy a nutrition bar. I have a vision for where this brand is going to be, and I’ve started recruiting people to help support me. My COO is a friend from college that was head of Operations at a high-growth snacking company. We bonded over our desire to create a better bar, and he has brought best practices from his previous experiences.

Stand Out With Data-Driven Stories

Companies that meet these criteria are rare – even more so today. So, when investors see such a company, they get excited and the same dynamics come into play. These best practices for fundraising apply in any economic environment.

Even today, the best companies are raising capital at premium valuations. One company we’re familiar with received 5+ term sheets this month in a very competitive process. In fact, there’s more competition for great companies. To best-position a business for a raise, focus on telling data-driven stories about your brand and avoid the things investors hate the most.

All Comments