How to

Calculate & Leverage Your Cost Of Goods

Ellen Rawley, founder of Ellen Rawley Creative & Strategy, helps food and beauty brands launch profitable, purpose-first products. Her work has been applauded in leading magazines (Food & Wine, Oprah, Martha Stewart), distinguished by industry awards (sofi, Good Food), and snatched up by buyers in major grocery, spa, and e-commerce outlets.

It’s important, especially when shifting strategies or expanding into new sales channels, to take a look at your cost of goods (COGS) so that you don’t end up running a food charity instead of a food business.

Ever felt like sales are up, but you’re not making any money?

If you’re not sure what your cost of goods are, don’t feel ashamed. Around 75% of the clients I work with don’t know their cost of goods when we start working together. When we dig in, I usually find the same thing: on some of their products they are losing money with each sale.

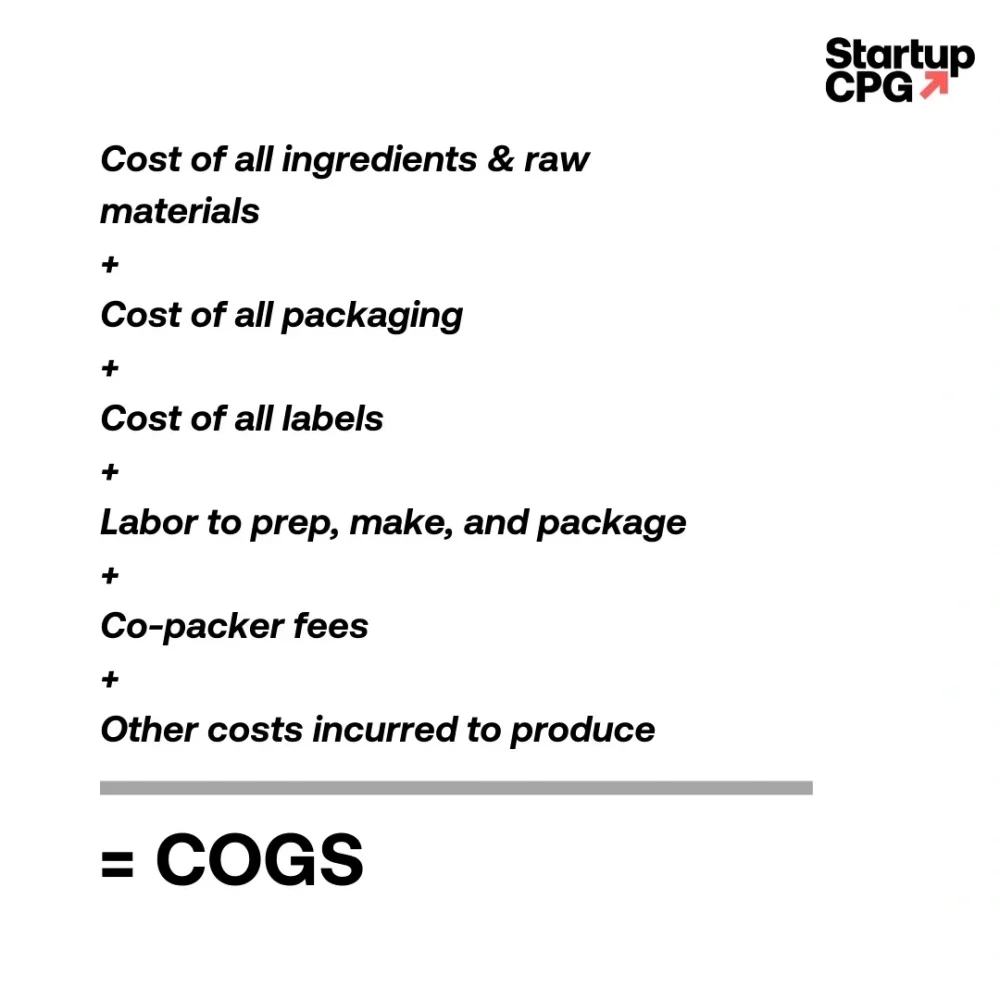

First, let me define which type of COGS I’m talking about. I am not referring to the lump sum reported to the IRS that shows how much money it took to make all your product throughout the entire year. I am talking about how much money it takes to produce one unit of each of your individual products. Included in COGS is the cost of:

1. Ingredients & raw materials

2. Packaging (jars, bottles, bags, etc.)

3. Labels

4. Labor to prep, make, and package the product

5. Co-packer fees if any

6. Other costs incurred to produce the product

When to Calculate Your COGS?

It’s a good business maintenance practice to set aside a day annually to update your COGS. Also, check back in with them when you expect they have shot up so you can strategize on how to respond. Such as when:

1. there is a significant increase in one of your costs (say an ingredient price soars)

2. you change something about your product (moving from labels to fancier silkscreened packaging)

3. labor costs rise

Similarly, do a quick update when you expect a COGS reduction such as when

1. you move from making the product yourself to working with a co-packer

2. as ingredient and packaging costs go down with scale

When your COGS go down, your margins increase making new sales partnerships or promotions possible.

Why Calculate Your COGS That Regularly?

Costs often change incrementally. Five cents here and ten cents there is easy to overlook just like how gaining weight one pound at a time can creep up on you until the day that there is no way to zip up your jeans.

1. The price of one of your ingredients goes up by just one dollar a pound.

2. Your vendor stops carrying your jar so you switch to a different vendor that charges extra delivery fees.

3. New regulations require you to keep track of your daily sanitation procedures and the added paperwork means production is a tad bit slower.

All of these changes seem insignificant, but their cumulative effect can cut into your margins significantly.

Say you have a product with a suggested retail of $10, and it costs you $2 to make.

– You sell 20,000 units a year at an $8 profit. You’re making $160,000 / year.

– If your COGS go up $1 per unit, it now costs you $3 to make your product. Your profit is reduced to $7 per unit and you’re making $140,000 / year.

– That’s a $20,000 loss from a 1$ change in COGS!

Though this is an oversimplified example, it shows how a change in a product’s COGS can quickly eat into profits. This is what leads many of my clients to say something to the effect of “I’m selling more product than ever, but I don’t seem to be making any money.”

How to Increase Profits by Bringing Down Your COGS

You run your COGS and you realize that you are losing money selling a specific SKU to wholesale accounts. What can you do? First, look at whether you can make changes to bring your COGS in line with your current pricing, such as:

1. Purchasing larger quantities of packaging elements

2. Tweaking recipes to reduce the quantity of an expensive ingredient

3. Sharing ingredient delivery costs with other food businesses nearby

4. Creating focused phases of production to increase how many units you can produce a day

5. Getting rid of labor-intensive labelling elements like hand-applied lid labels

6. Moving to pre-printed boxes or bags

Be realistic about your scale when searching for the right solution, balancing your desire to bring down COGS with the need to keep inventory costs in line. As you reduce your COGS you will increase your margins. One of my clients was able to increase their margins by 9% by taking out some of the nuts in their product and shifting from boxes they had to fold to ones that had an auto-bottom.

Only after you’ve exhausted your options to reduce COGS should you look to raise your prices.

All Comments